Your Corporate Banking Operations, Fully Observable

Track B2B transfers, bulk salaries, and EMI collections across every system. VuNet correlates file uploads, validation, payment rails, and settlements into one unified view—showing exactly where transactions flow or fail.

Delivers Visibility Across 28B+ Monthly Transactions

The Corporate Banking Observability Challenge

Fragmented Tools Create Blind Spots

Payment operations span file servers, validation engines, processors, CBS, and settlement systems—each with separate monitoring. Hours wasted correlating logs while transactions hang in limbo.

Scale Overwhelms Traditional Monitoring

$100M across NEFT, RTGS, IMPS rails. Generic APM tools can't handle banking volumes or understand cut-off criticality. Critical issues surface only after clients complain.

Technical Metrics Miss Business Impact

Stuck salary files affect thousands. Failed vendor payments disrupt supply chains. Your monitoring shows CPU spikes, not which corporate client's $10M payment is failing.

Worse, you can't differentiate between Platinum and Bronze tier client problems until tickets are raised, leaving VIP customers waiting like everyone else.

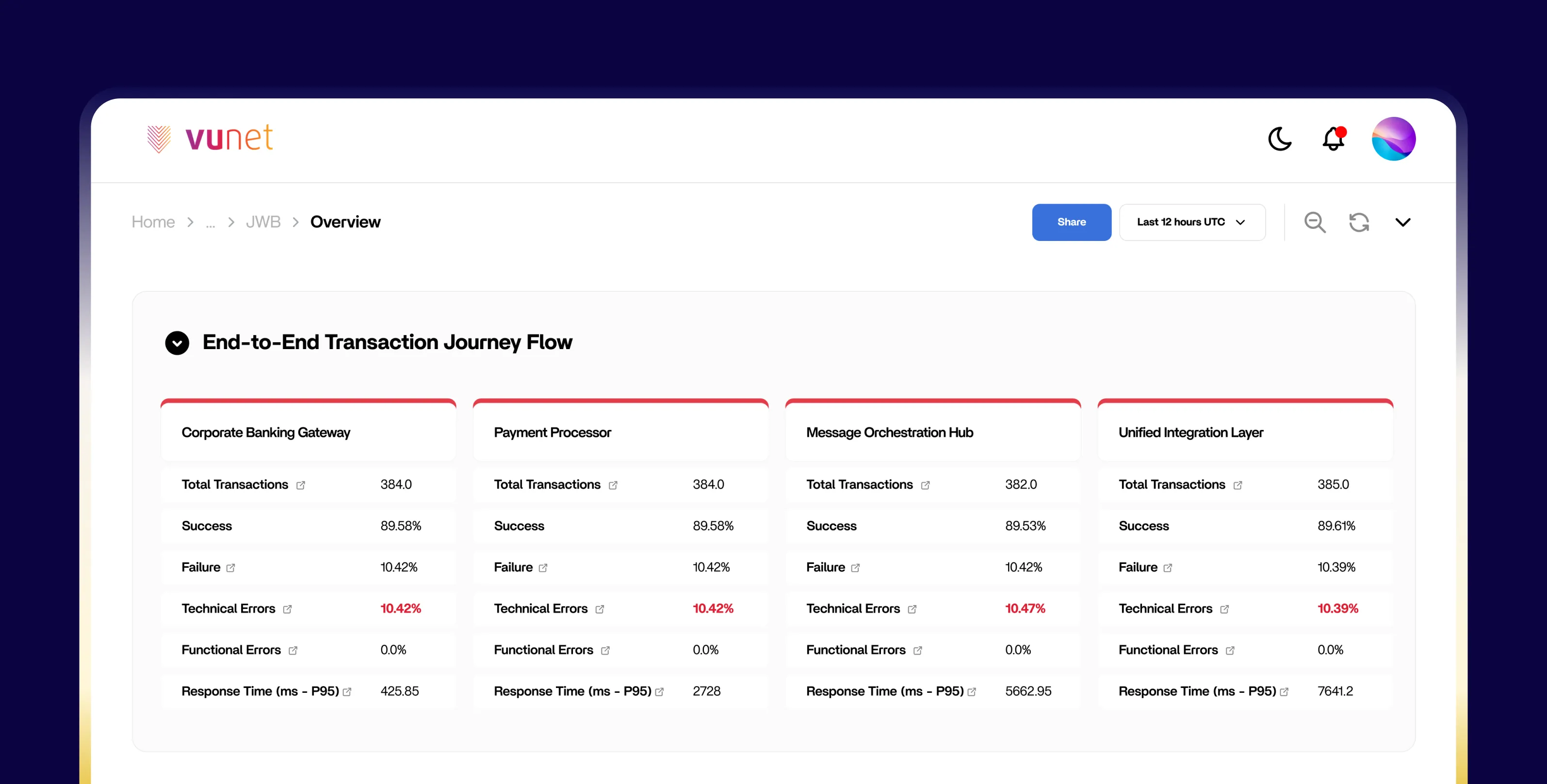

Zero Blind Spots at Billion-Dollar Scale

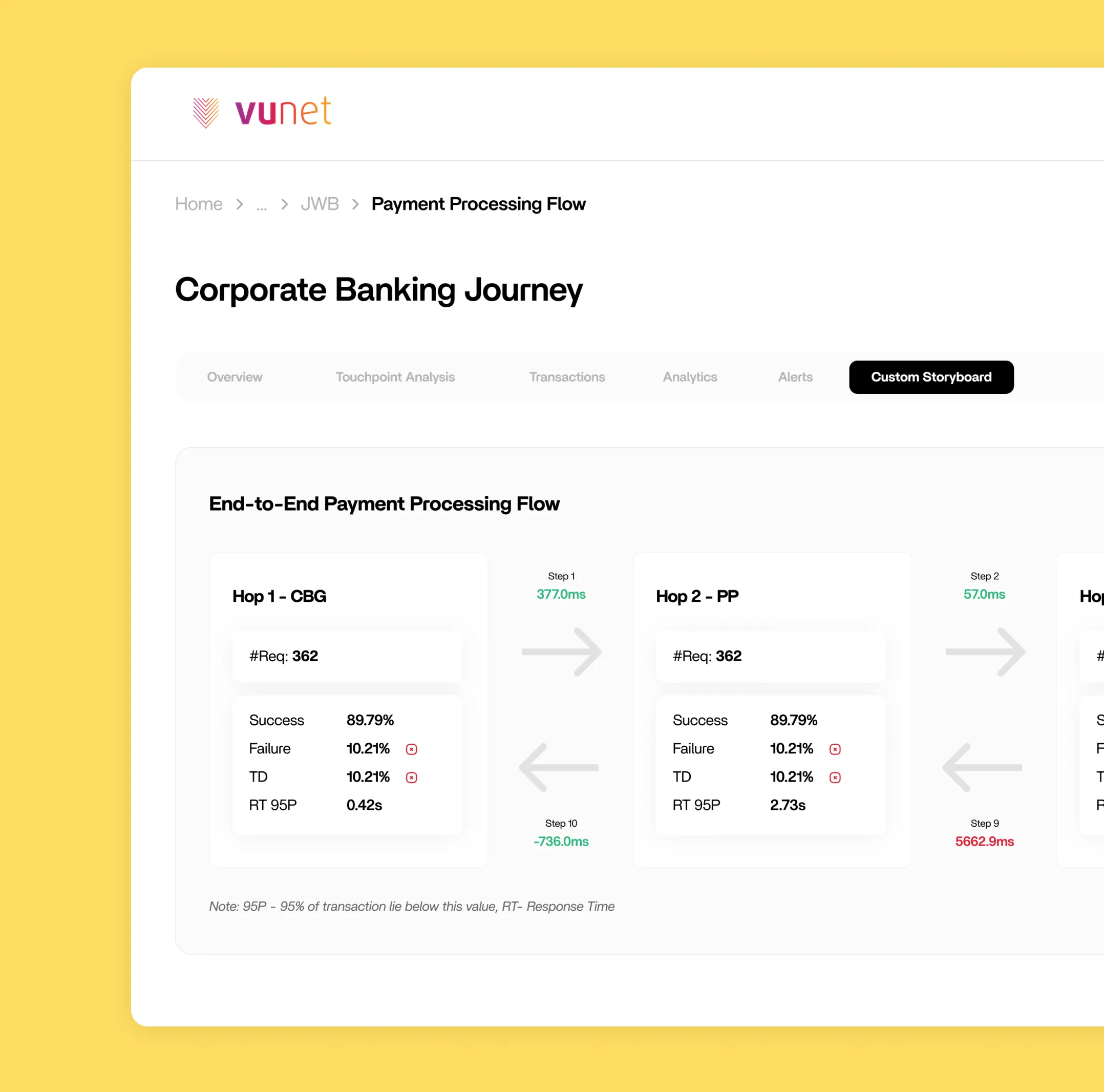

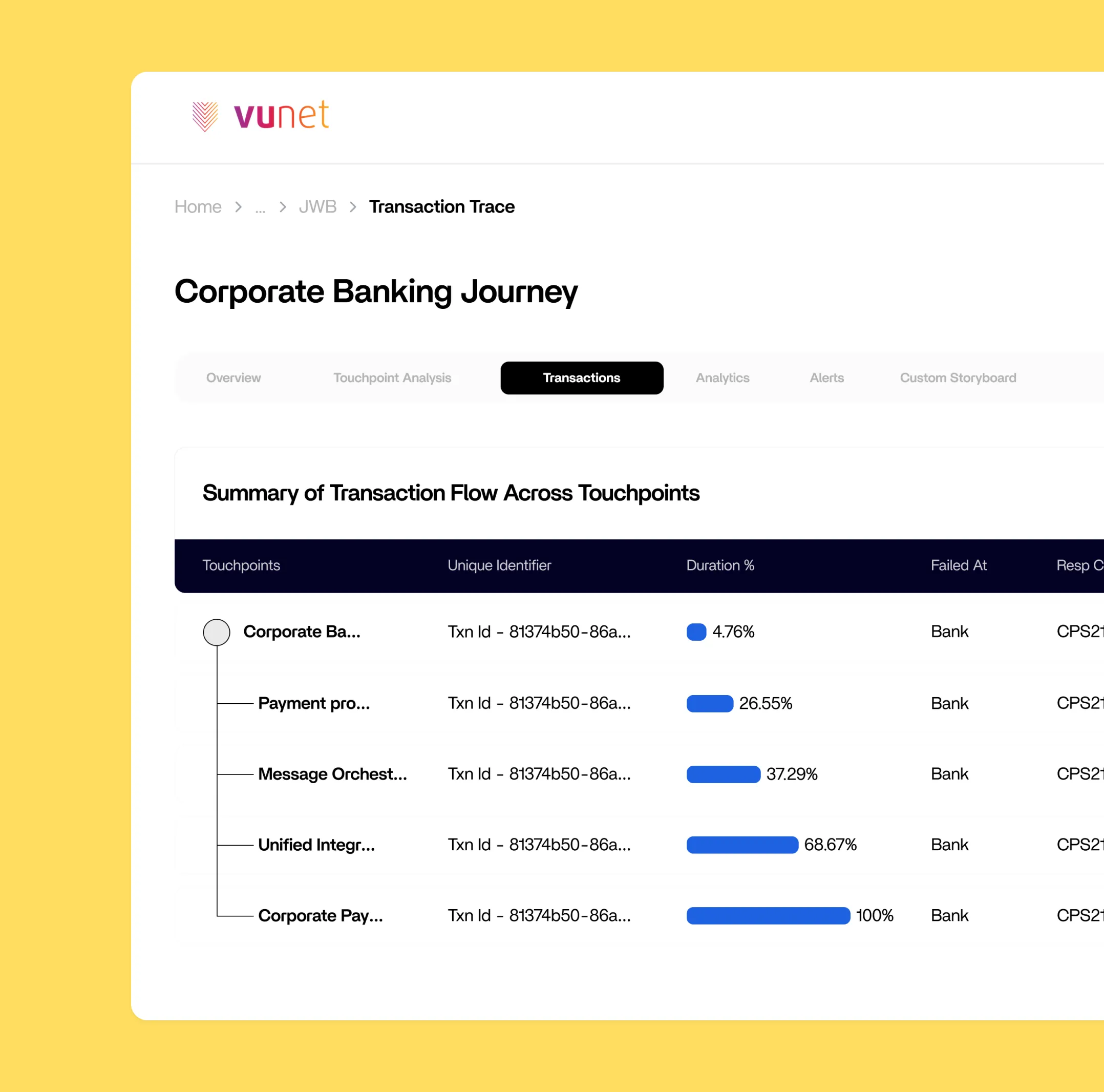

Complete Transaction Journey Tracking

- Follow every corporate payment from file to settlement across all systems—validation engines, payment processors, and CBS.

- See exactly where transactions flow or fail with full business context: client names, transaction IDs, SLA impact.

Monitor Every Processing Stage

- File Reception: Real-time tracking, format validation, error detection

- Payment Processing: NEFT, RTGS, IMPS performance across all channels

- Acknowledgment Delivery: Web, email, Host2Host, SFTP confirmation tracking

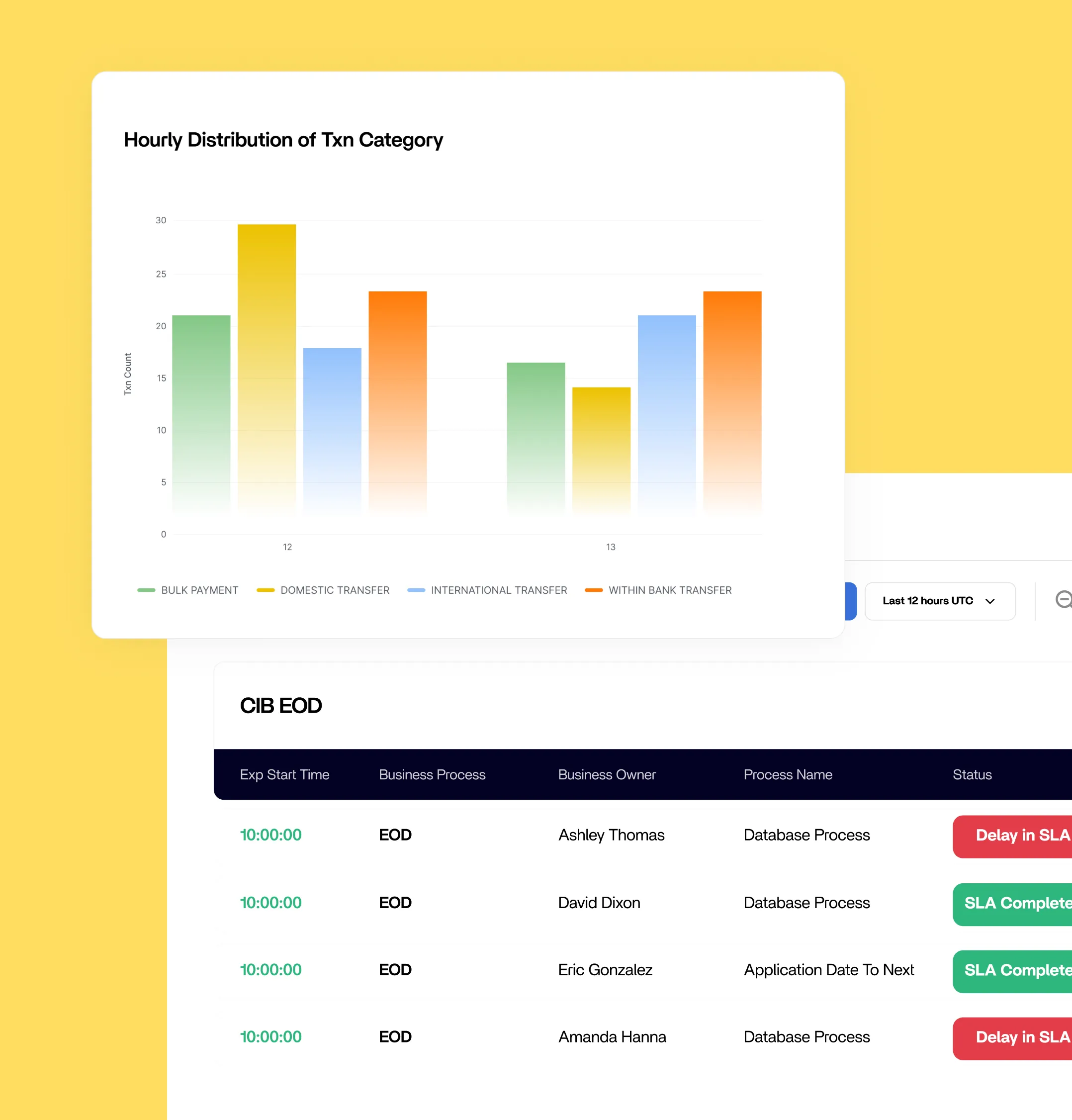

Track Business-Critical Workflows

- Salary Processing: Bulk file validation → debit execution → credit distribution

- EMI Collections: Mandate verification → retry mechanisms → settlement reconciliation

- Vendor Payments: Multi-level approvals → forex processing → correspondent banking

- Corporate Transfers: High-value monitoring → dual authorization → compliance checks

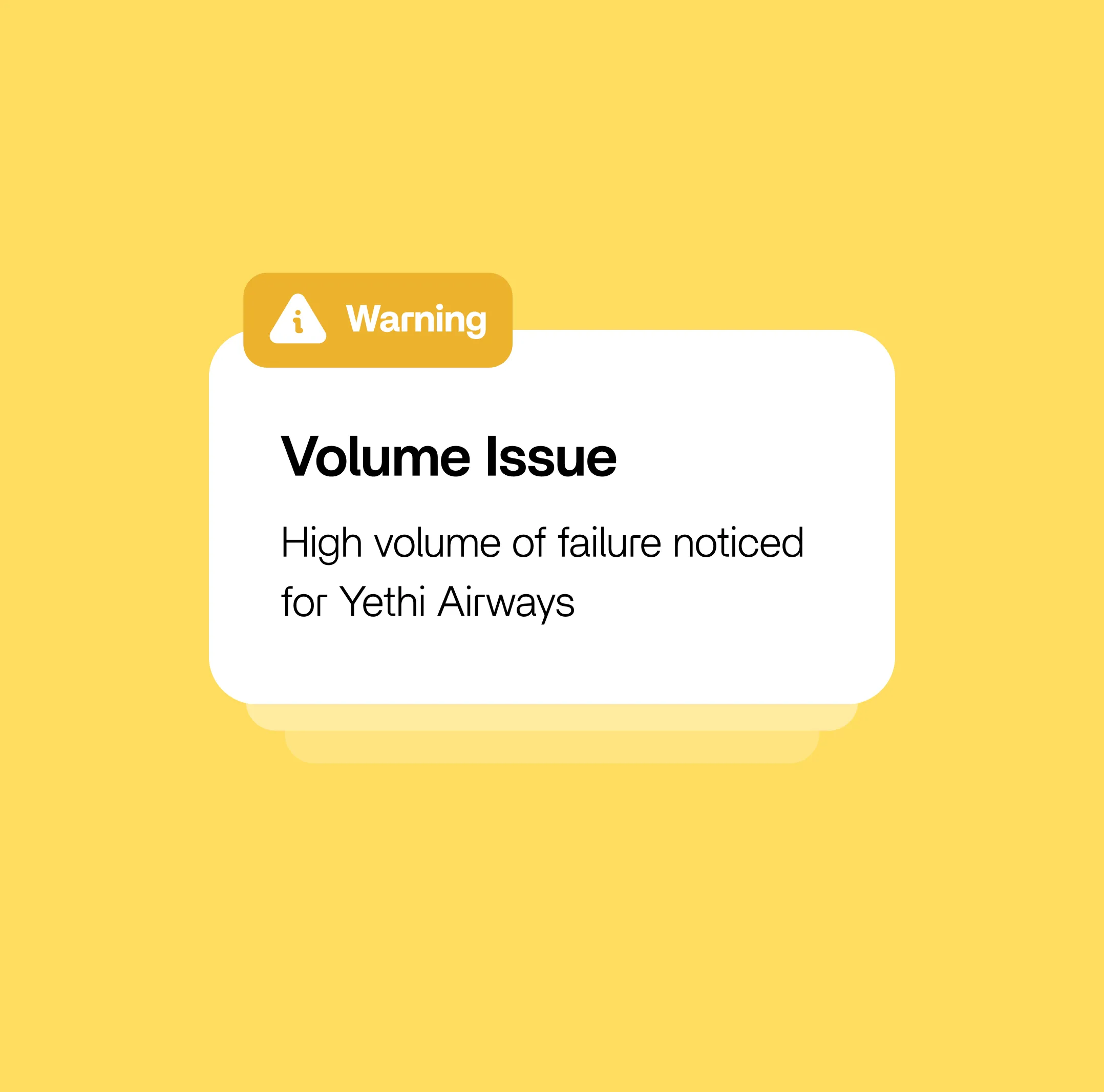

Set Up And Receive Contextual Notifications

- Processing delays approaching cut-off times

- Queue build-up exceeding thresholds

- VIP corporate customer transaction failures

- Batch processing anomalies

- Client tier-based alerts (Platinum, Gold, Silver SLA breaches)

AI-Powered Early Warning System

RCABot identifies payment anomalies before clients notice. Detect processing patterns, queue buildups near cut-offs, validation failures—with automatic root cause analysis and confidence scoring.

Business Observability That Delivers Bottom-Line Results

Built For Enterprise-Scale Corporate Banking Operations

Built for Banking, Not Retrofitted

Domain-specific intelligence with pre-built understanding of corporate payment workflows, ISO8583, ISO20022, and 3DSS compatibility.

Deploy Without Disruption

300+ pre-built adaptors connect instantly to your systems. Zero instrumentation required—deploy in your environment without touching code.

Handle Scale

10X faster data ingestion processes terabytes daily. Built for the volumes only banks experience.

In-House Expertise

Our dedicated implementation and solution engineering team ensures success without third-party dependencies.